unemployment benefits tax refund status

WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. Click on TSC-IND to reach the Welcome Page.

Report Unemployment Benefits Income On Your Tax Return

By Anuradha Garg.

. You do not need to take any action if you file for unemployment and qualify for the adjustment. Select Check the Status of Your Refund found on the left side of the Welcome Page. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

All claimants who are currently receiving unemployment benefits as of January 5 2020 will continue to receive their current maximum weekly benefit amount. The agency had sent more than 117 million refunds worth 144 billion as of Nov. All of the federal taxes withheld will be reported on the 2021 return as a tax payment.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Enter the figures from your form on the eFile platform and the Tax App will calculate the taxes owed on. The law that made up to 10200 of jobless income exempt from tax took effect in Mar.

Unemployment benefits are fully taxable in Maine. Less than 44950. For those early returns the IRS is making adjustments from its side and people dont need to do anything to get the refund.

The American Rescue Plan pandemic relief bill switched up the law so that people who collected unemployment in 2020 could exclude up to 10200 of unemployment payments from their income on their taxes that year so long as their total income was less than 150000. Waiting for your unemployment tax refund about 436000 returns are stuck in the irs system. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. You will receive back a percentage of the federal taxes withheld based on. Check The Status Of Your Income Tax Refund.

On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. 22 2022 Published 742 am. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months.

Use the Unemployment section under Wages Income in TurboTax. 58 on taxable income less than 22450 for single filers. The IRS efforts to correct unemployment compensation overpayments will help most of the affected.

Thats the same data. Many people had already filed their tax returns by that time. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in Box 1 the total unemployment compensation paid in 2020.

The post contains a screenshot from the IRSs app IRS2Go informing the user that Your refund amount has been reduced by 1342440 to pay a. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. In the latest batch of refunds announced in November however the average was 1189.

Unemployment compensation is taxable income which needs to be reported by filing an income tax return. Married couples filing jointly could exclude up to 20400 in jobless payments. If the IRS has your banking information on file youll receive your refund via direct deposit.

Heres what to know about paying taxes on unemployment benefits in tax year 2021 the return youll file in 2022. The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to 10200 of unemployment benefits on their 2020 tax return. September 13 2021.

Enter the whole dollar amount of the refund. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. State Income Tax Range.

You should receive a 1099-G reporting the unemployment compensation you received during 2021 to be reported on your 2021 Return in 2022. Please read the Frequently Asked. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. State Taxes on Unemployment Benefits.

Effective January 5 2020 the Maximum Weekly Benefit Amount in the District of Columbia has increased from 432 to 444 for new initial claims. A post on Facebook suggests that. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

This newest cash windfall is from President Joe Bidens 19 trillion American Rescue Plan which was able to waive federal tax on up to 10200 of unemployment benefits that were collected by. Some states may issue separate forms depending on the jobless benefits for example if you received federal pandemic. TurboTax cannot track or predict when it will be sent.

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Check The Refund Status Through Your Online Tax Account. If both members of a married couple were receiving unemployment they could both deduct up to that amount.

IR-2021-159 July 28 2021. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

What Do You Need To Do To Get A Jobless Benefits Tax Refund. The IRS has not provided a way for you to track it so all you can do is wait for the refund to arrive. IR-2021-212 November 1 2021.

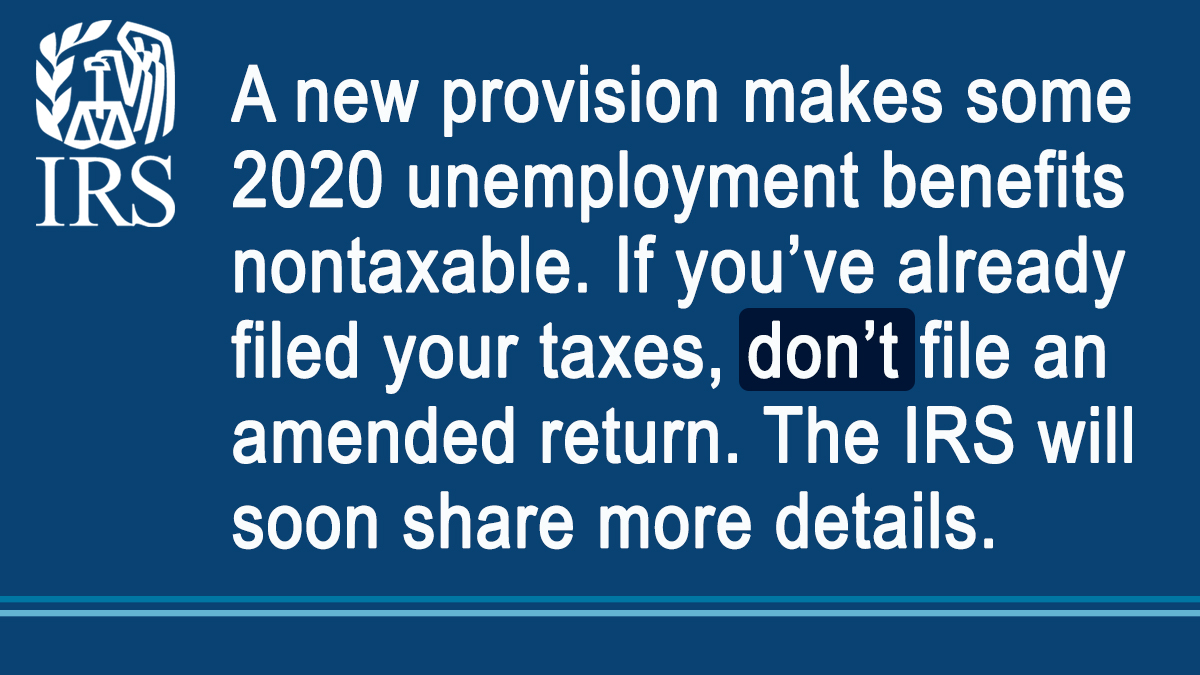

Irsnews On Twitter If You Received Unemployment Benefits Last Year And Already Filed Your 2020 Tax Return Don T File An Amended Return Irs Will Be Issuing Guidance To Address Changes Brought By

Interesting Update On The Unemployment Refund R Irs

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

1099 G Unemployment Compensation 1099g

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Get A Refund For Taxes On Unemployment Benefits Solid State